1099 B

Advertisement

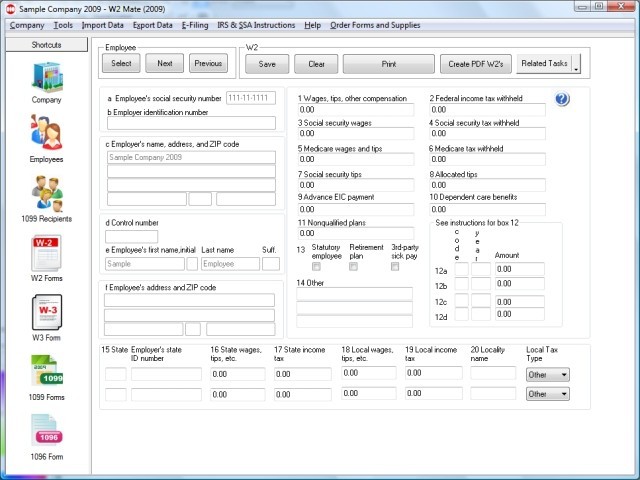

2009 W21099 Filer v.2. 1. 2010

W2/1099 Filer - is designed for fast and accurate data entry and easy printing of W-2's and 1099's.Includes Forms W-2, W-3, 1096, 1099-R, 1099-MISC, 1099-INT, 1099-DIV, 1099-S, and 1098.

Advertisement

Account Ability Tax Form Preparation v.22.00

Account Ability prepares information returns (1098, 1099, 3921, 3922, 5498, W-2G) and annual wage reports (W-2, W-2C) electronically, on laser, inkjet and generic dot matrix printers. IRS Bulk TIN Matching is included for free.

W2 Pro v.2009.12.21

W2 Pro is the easiest and most advanced software for filing all of your W2 related forms.

1042-S Pro v.2009.12.21

1042-S Pro is the easiest and most advanced software for filing all of your 1042-S forms.

EzW2 2010 - W2/1099 Software v.4.0.1

ezW2 2010 is a W2/1099 printing software. It was approved by SSA (Social Security Administration) to print forms W2 Copy A and W3 in black and white on plain paper.

EzW2 2011 - W2/1099 Software v.5.0.6

ezW2 is a W2/1099 printing software. It was approved by SSA (Social Security Administration) to print forms W2 Copy A and W3 in black and white on plain paper. This eliminates the need for buying the red-ink forms and calibrations.

EzW2 2012 - W2/1099 Software v.6.0.1

ezW2 is a W2/1099 printing software. It was approved by SSA (Social Security Administration) to print forms W2 Copy A and W3 in black and white on plain paper. ezW2 also supports PDF printing and eFile features.

Form 1099 S Real Estate Software v.2011

W2 Mate is 1099-S Software used to prepare IRS Proceeds from Real Estate Transactions 1099 S forms.

1099-SA v.1

File Form 1099-SA, Distributions From an HSA, Archer MSA, or Medicare Advantage MSA, to report distributions made from HSA, Archer MSA, or Medicare Advantage MSA (MA MSA).

1099-R v.1

A Form 1099-R is generally used to report designated distributions of $10 or more from pensions, annuities, profit-sharing and retirement plans, IRAs, and insurance contracts.